The protracted legal confrontation between Ripple Labs Inc. and the US Securities and Exchange Commission (SEC) is advancing towards a critical juncture, as both parties face imminent deadlines for their remedies briefing submissions. This phase of the legal battle marks a significant step in the proceedings, potentially setting the stage for the case’s potential resolution.

Attorney James K. Filan highlighted the upcoming schedule on X today, noting key dates: the SEC’s opening brief is due on March 22, followed by Ripple’s opposition brief by April 22, and concluding with the SEC’s reply brief slated for May 6.

#XRPCommunity #SECGov v. #Ripple #XRP Below is the revised schedule for remedies briefing: (1) @SECGov’s opening brief is due on March 22, 2024, (2) @Ripple’s opposition brief is due on April 22, 2024, and (3) @SECGov’s reply brief is due May 6, 2024.

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) March 14, 2024

These dates come after Ripple was granted a one-week extension in February for remedies-related discovery, shifting the deadline from February 12 to February 20. This extension was necessitated by a ruling in favor of the SEC by Judge Sarah Netburn, which required the company to produce a substantial volume of documents on the XRP sales for 2022-2023 within a constrained time frame.

Moreover, in late February, the SEC, represented by Jorge G. Tenreiro, sought an additional week to file remedies-related briefing to Judge Analisa Torres. This request was aimed at allowing sufficient time for the review of recently produced documents and the finalization of their briefing, a move that Judge Torres approved in early March.

What To Expect From The Ripple Vs. SEC Remedies Briefing?

According to John Deaton, an advocate for XRP, a settlement between both parties seems off the table for the moment. In recent weeks, he candidly discussed the case’s trajectory, emphasizing the absence of settlement discussions between both parties.

Deaton’s observations reflect a stern legal stance from the SEC, highlighted by their motion to compel Ripple to release its audited financial statements for 2022–2023 along with details on institutional sales post-complaint, a move Deaton interprets as “scorched earth litigation.”

Reflecting on the SEC’s steadfast approach, Fred Rispoli, another voice from the XRP community, recently expressed initial optimism for a de-escalation but acknowledged the intensifying focus of the case. Rispoli’s remarks underscore the gravity of the SEC’s demands for financial documentation post-lawsuit filing, suggesting a strategic move to scrutinize Ripple’s current operational compliance.

He speculated, “The ultimate takeaway is that the SEC is still going after the jugular for Ripple to restrict/kill its institutional operations. This whole briefing is going to focus on Ripple’s current operations and how they are different from what got whacked in the MSJ. The stakes are still very high (for Ripple not XRP) unfortunately.”

Deaton, touching on the potential financial repercussions for Ripple, proposed that the fines could range “from $10 million to $100 million,” a figure significantly less than the estimated $200 million Ripple has expended on its legal defense. Deaton’s outlook remains hopeful for appellate support of Judge Analisa Torres’s decisions regarding the sale and distribution of XRP, envisaging the remedies phase as a comprehensive legal challenge in itself.

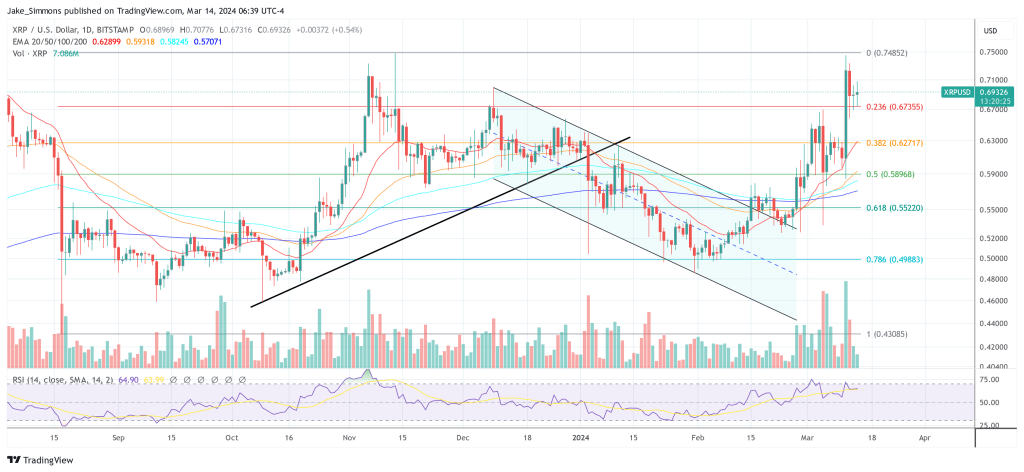

At press time, XRP traded at $0.693.

Featured image created with DALL E, chart from TradingView.com

Wow, wonderful blog layout! How lengthy have you ever been blogging for?

you made blogging glance easy. The whole look of your site is

wonderful, as smartly as the content material! You can see similar

here e-commerce