Quick take:

- The Ethereum Foundation has released its 2022 annual report

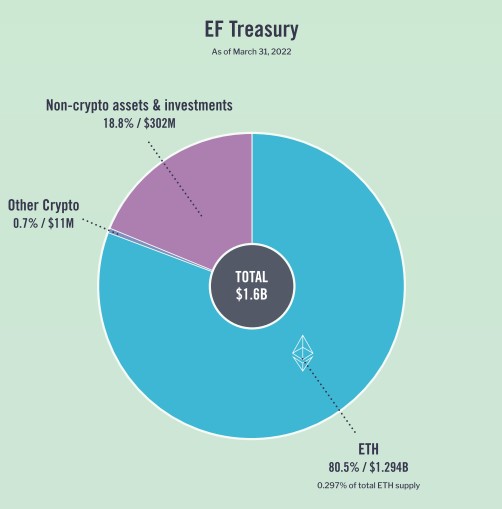

- As of March 31st, 2022, the Ethereum Foundation holds approximately $1.6 billion in its treasury

- $1.3 Billion is in crypto and $300 million in non-crypto investments and assets

- 99.1% of its crypto holdings are in ETH, representing 0.297% of the total supply and 80.5% of its treasury

- The Ethereum Foundation wants its impact to span decades and centuries

The Ethereum Foundation has released its 2022 annual report.

The report hopes to help the community understand the Ethereum Foundation, its philosophy and core principles, and its vision for Ethereum.

According to the report, the Ethereum Foundation is a non-profit organization that supports the Ethereum ecosystem. The foundation describes itself as not being a tech company or an ordinary non-profit. It prefers to consider itself a ‘new kind of organization that supports a blockchain without controlling it.’

Ethereum Foundation Holds $1.6B in its Treasury, $1.3B or 80.5% in ETH, Which is 0.3% of the Total Supply

In the financial summary of the report, the Ethereum Foundation declares that as of March 31, 2022, it has approximately $1.6 billion in its treasury. Of this amount, $1.3 Billion is in crypto assets, with the remaining $300 million in non-crypto investments and assets.

Of the $1.3 Billion in crypto assets, 99.1% is held in ETH, representing 0.297% of the total Ethereum supply as of March 31, 2022. Additionally, this amount of Ethereum represents 80.5% of its treasury.

Ethereum Foundation Believes in ETH’s Potential

The Ethereum Foundation explains in the report that it follows a conservative treasury management policy to fund its core objectives, particularly during a multi-year market downturn. Such a policy guarantees that its budget is immune to the changes in the price of ETH.

As explained below, the foundation also states that it has increased its non-crypto savings as a hedge against market volatility.

We also increase our non-crypto savings in response to rising ETH prices, which provides a greater safety margin for our core budget and would enable us to continue funding non-core but high leverage projects through a market downturn.

We choose to hold the remainder of our treasury in ETH. The EF believes in Ethereum’s potential, and our ETH holdings represent that long-term perspective.

Ethereum Foundation Impact to Span Decades and Centuries

Its approach to finances further reinforces the Ethereum Foundation’s core principle of ‘long term thinking’. It wants its impact ‘measured in decades and centuries – not quarters and fiscal years.’

‘Like a gardener,’ the Ethereum Foundation is ‘planting seeds that [they] might not live to see grow.’