Crystal Blockchain, a company that provides blockchain data and analytics, published a study covering security breaches, fraud, and scams related to cryptocurrency and decentralized finance (defi). According to the study, approximately $16.7 billion in crypto assets have been stolen since 2011. Last year, Crystal’s intelligence team documented 199 incidents resulting in the theft of $4.17 billion in crypto assets. So far this year, there have been 19 different incidents resulting in the theft of $136 million.

Top Countries Targeted by Crypto-Related Incidents: United States Leads in Frequency, China Tops in Value

On Tuesday, Crystal Blockchain released a report providing a comprehensive analysis of fraudulent activities and security vulnerability attacks since 2011. The report reveals that during the past 12 years, there were 461 incidents that took place in 45 countries, resulting in $16.7 billion in stolen crypto assets.

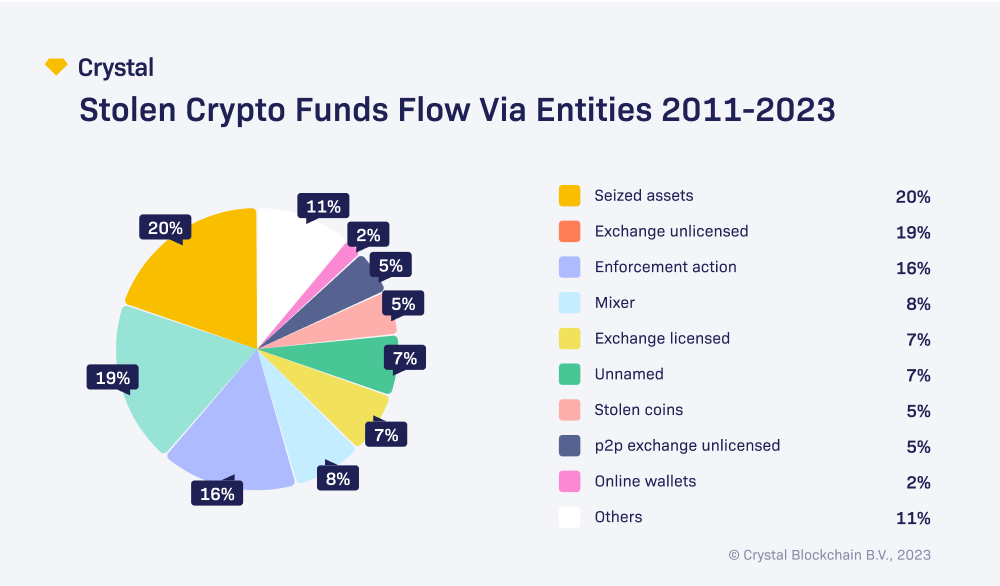

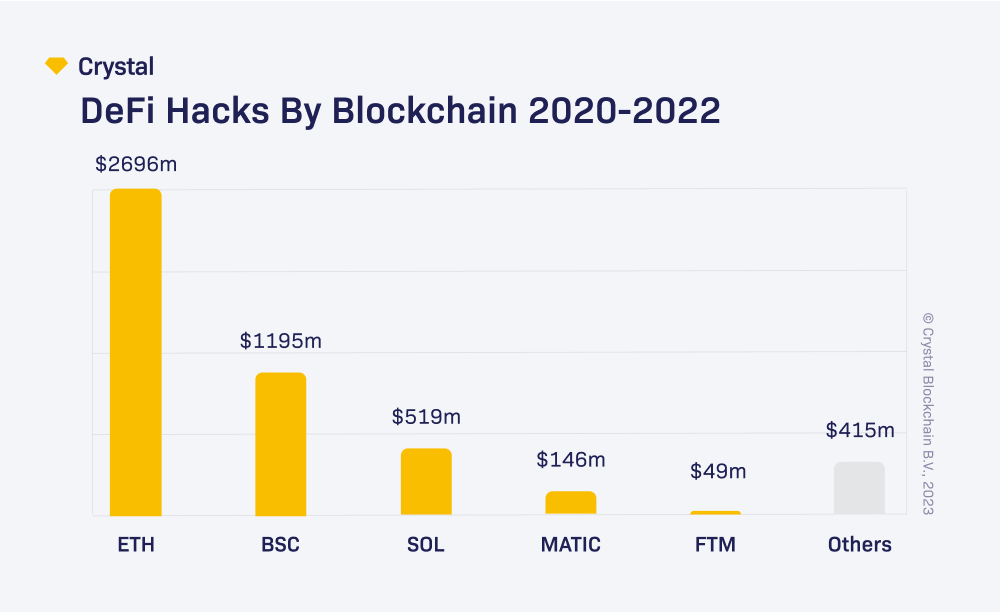

According to Crystal’s intelligence report, 231 defi hacks, 135 security attacks, and 95 fraudulent schemes were reported during this period. Defi hacks ranked second in terms of value, with $4.81 billion stolen, while scams resulted in more than $7.5 billion in stolen crypto assets.

According to the study, the United States has the highest number of incidents against crypto companies and bad actors. However, in terms of overall value, China ranks highest due to the Plus Token Ponzi scam in 2019 and the Wotoken Ponzi in 2020.

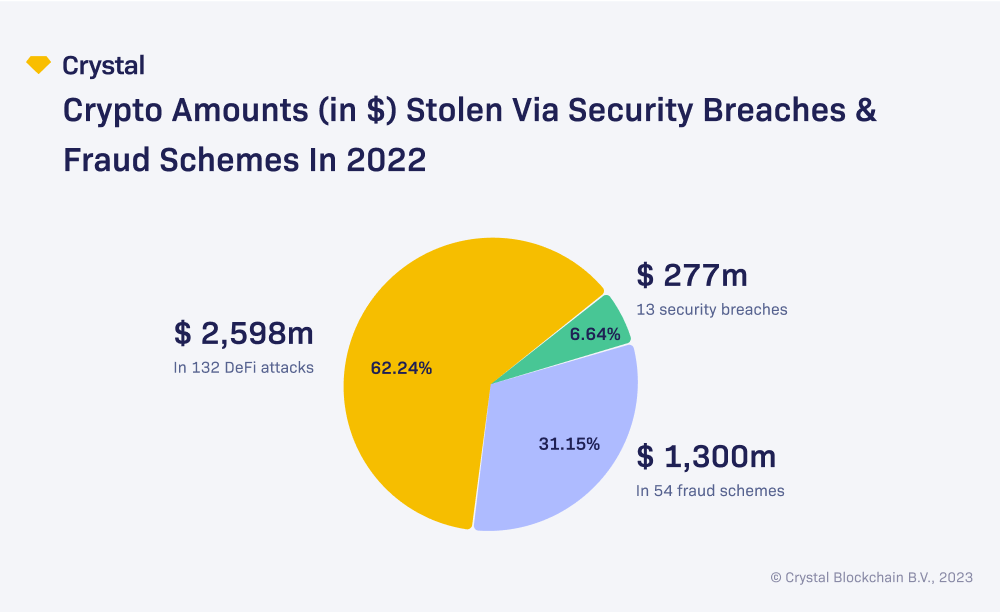

Crystal researchers state that until 2021, the most popular attacks were against crypto-exchange security systems, but since then, attackers have shifted to decentralized finance hacks. Currently, Crystal reports that centralized exchange (cex) hacks cause the least amount of financial damage. “In 2022, the ratio of cex versus [decentralized exchange (dex)] hacks was as high as 1:13,” note Crystal’s researchers.

The largest defi hack to date was the Ronin network bridge hack in March 2022, resulting in the loss of over $650 million. The majority of the funds stolen in the Ronin hack were transferred to Tornado Cash, a cryptocurrency mixing service.

Crystal researchers note that “Tornado Cash remains the most popular service for laundering funds on the Ethereum Blockchain.” The report states that last year, stolen crypto assets from the top 10 defi exploits exceeded $2.61 billion. Additionally, non-fungible token (NFT) rug pulls became popular in 2022, with Crystal counting “48 successful scams” during the year.

Crystal Blockchain’s report in its entirety can be read here.

What do you think should be done to improve security measures in the cryptocurrency and decentralized finance (defi) space? Share your thoughts and ideas in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Crystal Blockchain,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer