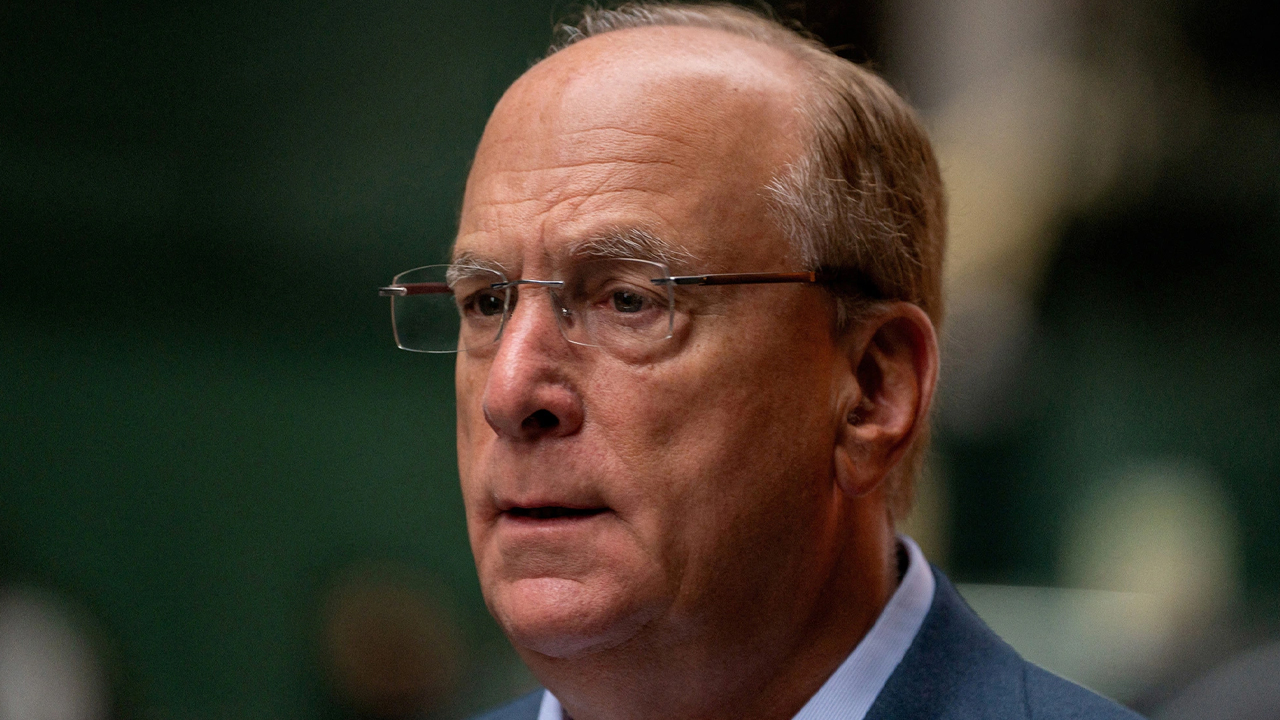

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.”

Blackrock Clients Reduce Risk in Portfolios as Inflation Concerns Persist

Larry Fink, chairman and CEO of Blackrock (NYSE: BLK), the asset manager with more than $9 trillion in assets under management (AUM), predicts that inflation in the U.S. will persist for a considerable amount of time. Fink was interviewed on Friday by the hosts of CNBC’s “Squawk on the Street” and stated that he does not anticipate a major economic downturn in the country.

“I am not expecting a big recession in the [United States],” Fink told the broadcast hosts. He also emphasized that the significant fiscal stimulus injected into the country needs to be “offset.”

While acknowledging that some sectors of the economy are “weakening,” Fink stated that “other sectors, because of these tremendous fiscal stimuli, are going to offset some of that.” The Blackrock executive also discussed inflation, emphasizing that he believes it “is going to be stickier for longer. In other words, I think we’re going to have a 4ish floor in inflation.”

Regarding a possible recession in 2023, he stated that he is “not sure we’re going to have a recession” and suggested it might occur in 2024. Fink also expressed bewilderment at the reaction to the fall of Silvergate Bank, Silicon Valley Bank, and Signature Bank.

Fink said:

This is not a systemic problem, this is not a problem that’s going to have impact. As we saw today we had our big banks having great quarters … performing really well. So I think this is just an example of, you know, when the sea or the tide goes out, some people are going to be left there.

In mid-March, Fink shared his views on the banking industry following the collapse of three banks and asserted that “we’re likely to see stricter capital standards for banks.” Fink’s latest evaluation, shared with CNBC hosts on Friday, coincides with recent remarks made by Blackrock’s chief investment officer of global fixed income, Rick Rieder.

Rieder anticipates that the U.S. Federal Reserve will increase the benchmark rate to 6% this year and maintain it at that level for an extended period to alleviate inflationary pressures. During his interview, Fink also informed CNBC that Blackrock’s clients are reducing risk in their portfolios.

“We’re seeing more and more clients who want to decrease risk while maintaining a more holistic and resilient portfolio by establishing a stronger foundation of bonds and equities,” Fink explained.

Further, the Blackrock CEO touted the company’s success over the past five years, boasting of “growing by $1.8 trillion in net inflows.” Despite “all this pessimism,” he emphasized that Blackrock grew “more in this first quarter than the first quarter of ’22.”

What do you think Larry Fink’s predictions mean for the future of the U.S. economy? Do you agree or disagree with the Blackrock CEO’s assessment of the inflationary environment and the likelihood of no recession in 2023? Share your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer