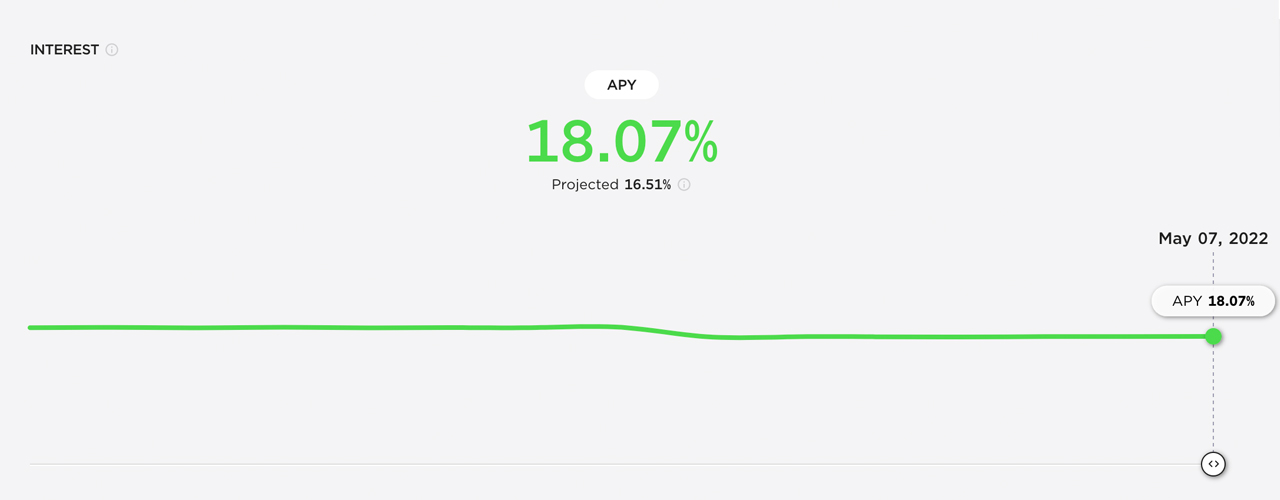

Following the governance vote that aimed to implement a semi-dynamic earn rate for the Anchor Protocol, the decentralized finance (defi) platform’s earn rate adjusted downward for the first time this month. After holding steady with a 19.4% annual percentage yield (APY) since the project started, Anchor Protocol’s earn rate is now roughly 18% APY for the month of May.

Defi Lending Protocol Anchor’s Earn Rate Adjusts Downward

The lending platform Anchor Protocol is the third-largest defi protocol today with $16.5 billion total value locked (TVL). Statistics show that during the last 30 days, Anchor’s TVL has increased 9.25% since last month.

Around 45 days ago, the team behind the lending protocol announced that a proposal had passed and the decentralized money market would have a fluctuating earn rate. Before the proposal, Anchor users who deposited terrausd (UST) would get a steady 19.4% APY earn rate on their UST deposits every month.

Since the governance vote passed, the first semi-dynamic adjustment took place at the start of May, and depositors today are getting roughly around 18% APY. Since the change took place, the earn rate can increase or decrease per period to 1.5% depending on the increase and decreases in yield reserves.

With the current 18% APY, the change means this month, depositors will be getting less than they used to get prior to the adjustment change. Furthermore, in June the earn rate could very well change again depending on the protocol’s yield reserves.

Anchor Protocol now supports two blockchains, as Avalanche support was recently implemented. While $16.27 billion stems from Terra-based tokens, $202.48 million worth of Anchor’s TVL is comprised of Avalanche-based tokens. Currently, there’s $2.9 billion that’s been borrowed from the Anchor Protocol in defi loans.

The Anchor earn rate fluctuation follows the recent defi forex reserve purchases made by the Luna Foundation Guard (LFG). The non-profit organization based in Singapore leverages the reserves to back terrausd (UST) and LFG holds 80,394 BTC worth $2.89 billion and $100 million in AVAX.

With Anchor Protocol changing its incentives to a semi-dynamic earn rate, it will be interesting to see if it affects the platform’s TVL, which has seen growth month after month. During the past 24 hours, Anchor’s TVL has dropped by 2.89% and this week it’s dipped by 0.66% in the past seven days.

What do you think about the Anchor Protocol’s earn rate adjusting? Do you think it will affect the defi protocol’s popularity? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer