Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations and he claims the allegations are “categorically false.”

LUNA 2.0 Token Drops 54% in Value During the Last 2 Weeks

The LUNA 2.0 rebirth token has been extremely lackluster in terms of market performance during the past two weeks. However, as Bitcoin.com News reported six days ago, a myriad of decentralized finance (defi) protocols have re-joined the ecosystem.

Terra’s 2.0 chain has roughly $1.32 billion locked in the Stader defi application according to defillama.com stats. The Terra Classic chain still has $10.54 million total value locked in defi today as well, with $3.11 million held on Terraswap and $2.47 million locked into Anchor.

During the past two weeks, after LUNA 2.0 tapped a high of $11.33 per unit, the new LUNA has lost 54% during the last 14 days. It is still down 86% from the all-time high at $18.87 per coin when the 2.0 blockchain was first launched.

At the time of writing, LUNA 2.0 has $135 million in global trade volume, which pales in comparison to the volume luna classic (LUNC) saw prior to the fallout. The top exchanges in terms of trade volume for LUNA 2.0 include Bitrue, Okx, Huobi Global, Kucoin, and Gate.io. LUNA 2.0’s top five trading pairs today include USDT, USD, USDC, EUR, and ETH, respectively.

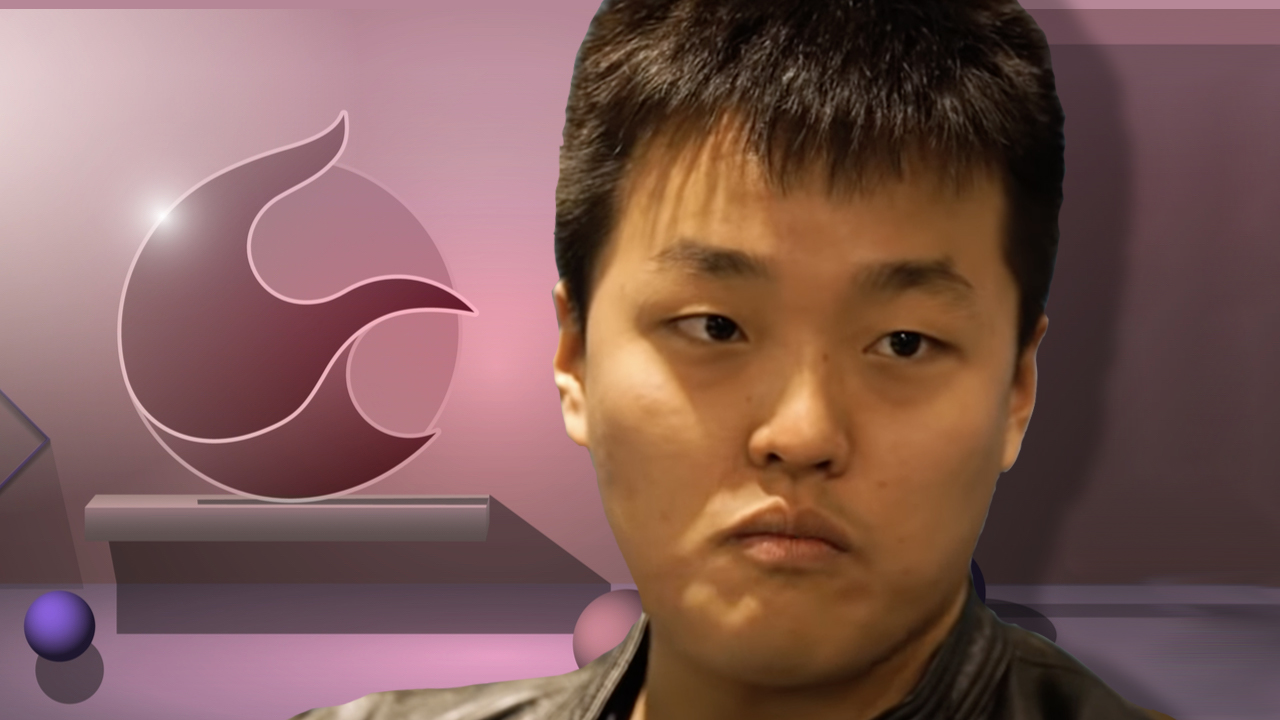

Terra Co-Founder Do Kwon Continues to Be Accused of Shady Acts — Whistleblower Fatman Claims Kwon Cashed Out $2.7 Billion Before UST Collapse

While LUNA’s market performance has not been so hot, alongside a variety of crypto assets suffering through the bear market, Do Kwon is still being accused of shady acts by the whistleblower Fatman.

Should we start using the term Kwonzi more often? I propose a definition.

Kwonzi: a financial scheme with borrowed elements from and a similar negative-sum nature to a Ponzi but not a Ponzi – cleverly obfuscated by sophisticated manipulation, legitimate technology, and jargon.

— FatMan (@FatManTerra) June 12, 2022

Three days ago, Bitcoin.com News also reported on the U.S. Securities and Exchange Commission (SEC) reportedly investigating the terrausd (UST) collapse and the company Terraform Labs (TFL). On June 11, 2022, Fatman accused Kwon of siphoning $2.7 billion from the Terra project a few months before the UST fallout.

“Some of you thought $80m per month was bad,” Fatman tweeted. “That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80 [million]) over the span of mere months thanks to Degenbox: the perfect mechanism to drain liquidity out of the LUNA [and] UST system and into hard money like USDT.”

Fatman says the defi borrowing protocol Abracadabra’s Degenbox and tokens like SPELL and MIM were used to provide “deeper exit liquidity to the UST pair.” The whistleblower said that Kwon was able to cash out via the MIM/UST pool to the tune of $2.719 billion without moving the peg.

“UST is the future, he said. Decentralized money is sound money, he said,” Fatman continued. “UST won’t de-peg, he told you. ‘Centralized stablecoins will rug you eventually.’ So why did he cash out $2.7b from UST into USDT and USDC?”

Do Kwon Refutes Cash Out Accusations, Says He ‘Really Doesn’t Care About Money Much’

However, Do Kwon has refuted the claims he cashed out $2.7 billion before the UST crash. “This should be obvious, but the claim that I cashed out $2.7B from anything is categorically false,” Kwon said the same day Fatman accused him. Kwon also has his Twitter account set to private mode and only people Kwon tags in a tweet can reply.

“Two contradictory claims seem to exist where: Do’s wallets are doxxed, and he still owns most of his luna through the airdrop [or] Do dumped all his tokens to make billions,” Kwon continued. “A lane should ideally be picked.” The Terra co-founder added:

To reiterate, for the last two years the only thing I’ve earned is a nominal cash salary from TFL, and deferred taking most of my founder’s tokens because a) didn’t need it and b) didn’t want to cause unnecessary finger-pointing of ‘he has too much.’

On Twitter, people have discussed how Kwon is a lot more humble now in comparison to calling people “poor” during LUNA’s peak fame. Others have been discussing Kwon reportedly “bending over” Abracadabra founder Daniele Sesta and “SPELL bagholders.”

The claims say tokens like SPELL, MIM and Abracadabra’s Degenbox were used to help Kwon siphon UST into harder stablecoin assets. Abracadabra and Sesta have already had their share of controversy in the past with the Wonderland TIME debacle.

[PEOPLE YOU MEET ON THE WAY UP, YOU MEET ON THE WAY DOWN]

Do Kwon (Ponzi @stablekwon) no longer cares about money. Remember his favorate insult was “poor”; he didn’t debate @Frances_Coppola because he “doesn’t debate the poor” & had “no change for her”.https://t.co/B7R8JWDWJT— Nassim Nicholas Taleb (@nntaleb) June 12, 2022

Terra’s co-founder Kwon stressed on Twitter that none of what is being said about him cashing out is true. “Hope that’s clear – I didn’t say much because I don’t want to seem like playing victim, but I lost most of what I had in the crash too,” Kwon concluded on Saturday in his refutation against the claims he cashed out $2.7 billion.

“I’ve said this multiple times but I really don’t care about money much. Please say things that are proven and true – if you are spreading falsehood that just adds to the pain of everyone who has lost,” Kwon added.

Meanwhile, Fatman continues to accuse Kwon of dirty tricks and the whistleblower has not stopped criticizing Kwon’s ostensible acts, or his current commentary and refutation.

What do you think about LUNA 2.0 and the recent accusations against Do Kwon? What do you think about Kwon’s refutation? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer